Google Cars Gets Ready To Retail Rumble

The last party to attempt such a feat was TrueCar, an innovative and well-intentioned company that ultimately ran afoul of dealers, regulators and the OEMs. TrueCar was forced to pull itself back from the brink and re-invent itself as a more dealer-friendly company, a process painstakingly documented by Ed and Bertel before I ever appeared on the masthead.

What TrueCar did was distort the information asymmetry that car dealers rely on to make money. TrueCar was able to provide data on everything from dealer invoice to transaction prices and allowed dealers to compete with one another for a sale – a major taboo in the world of car sales.

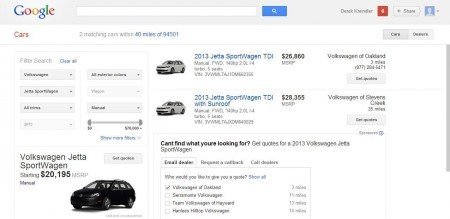

Now, Google is rolling out a service, the imaginatively named Google Cars, beyond its initial Bay Area test market. Consumers will be able to log onto Google Cars and use the handy one-stop filter box (rather than clicking through various menus and sub-menus to boost a given site’s pageview count) and get inventory, pricing and retailer information for the exact car they’re looking for, down to the color. With 66 percent of dealer website visits arriving from Google, it only makes sense for the tech giant to try and capture some of that value. Under the Google program, users can shop for their cars via the first page of any given Google search. Google will get a minimum of $10 per lead, which is determined by a bidding system. One California Toyota dealer told Automotive News that he was paying $22 per car and $26 per truck or crossover, slightly more than the $20 paid to competing services.

Reviews have been mixed, according to AN. Some dealers like the flexibility of bidding for leads, while others expressed frustration that potential customers can contact dealers anonymously (via disposable phone numbers or email accounts, which expire after a set number of unanswered calls or emails), which they say diminishes the effectiveness of the leads.

Regardless of the potential issues, Google Cars cannot be ignored. Google’s massive size and resources will allow it to be far more aggressive than TrueCar ever was when interacting with dealers and OEMs. Regulators may be a thorn in Google’s side (never underestimate the lobbying power of NADA and other dealer bodies), but again, it has the resources to put up a proper fight against the usually dominant entities.

On a smaller scale, Google Cars is likely to cause a lot of headaches for the established players in the online auto retail spaces. Current juggernauts like Edmunds, Kelley Blue Book, Cars.com and even TrueCar are all threatened by Google Cars, thanks to the strength of the Google brand and most of all, the superior user experience. Once consumers know that they can access a high-quality car shopping tool without ever leaving Google and have the benefit of Craigslist-style anonymity it will be a tough sell for the other sites to get their customers back. About the only criticism levied at Google Cars in this area is the lack of content, like car reviews and automotive news. But Google has never been a content company and they are wise in avoiding this space. Better to aggregate the near-infinite amount of automotive content (aggregation is one of Google’s strengths, after all) that will likely be consumed by dedicated auto enthusiasts rather than consumers. A successful Google Cars could also cause indigestion further down the on-line food chain, at sites that live mostly off selling leads, and who dress-up the lead generation with content, which all too often is not their own.

Aside from the millions it should generate for Google, the car shopping tool is yet another way for them to collect data on consumer purchases. In this case, Google will amass significant personal information relating to what is likely the second largest purchase of one’s life, data that goes beyond whether you like a tan interior or a manual transmission. Google already can sense purchase intent from your browsing data, actively perusing a shopping service would confirm this intent. Yes, it’s ironic considering that Google subscribes to the idea that “information wants to be free“, but there’s a reason behind the internet adage “if you’re not paying for it, you are the product”.

Nouvelles connexes