Tales From The Cooler: The Land Of The Crooked Car Buyer – Part Two

In Part One we looked at Lemon Law scofflaws and odometer clockers. Today we will examine the crooked schemes that can be used to obtain the vehicle of your dreams. We will begin with the case of robber Baron Haghighi, who last month tried to con a few cars out of several Southern California high-line dealerships.

Mr. Haghighi has been running fake check scams in the state of Washington since the 1990s and was recently released from prison. Apparently thinking that Cali dealers would fall for his ruse as had several Washington retailers, he presented himself as an Egyptian entrepreneur wanting to purchase several vehicles, in one case a fleet worth nearly $400,000. I am going to write you a check, said Haghighi, here is a letter from my bank verifying my funds. Composed on the letterhead of the Bank of Alexandria, the document is priceless:

…We hereby verify to you, with full bank responsibility, the availability of funds in the amount of Thirteen Billion United States Dollars ($13,000,000,000.00 USD) on deposit in our bank….(the funds) are to be maintained on deposit in our bank as of the date of this letter until 2010…

Haghighi and his rubber checks were dismissed from the LA stores with a flip of a wrist and a yawn from their sales managers. Los Angeles dealers see so many attempts at customer fraud they can identify dullards like this clown in about five seconds.

Exports

Although Haghighi was a novice in a city of seasoned crooks, his aim was likely the same as the pros: to dispose of the scammed vehicles in the lucrative car markets of China or Russia. This is part of the sea change in the past few years in criminals’ motivation to defraud banks and automakers out of cars - the strategy has switched from perps actually driving the vehicles to today’s tactic of disposing of them overseas. The money that can be made on these so-called “floaters” is flat-out stupid. A 2011 Mercedes-Benz C-Class recently purchased for $22,000 at a California auction sold to the end user for $46,000 in the Chinese gray market. The new Ford F-150 SVT Raptor is currently commanding three times its MSRP in China, or over $160,000.

Most luxury automakers penalize dealers for exporting new vehicles outside the United States, but there are always stores looking for the quick buck. The greedy sales manager who gets a call from someone looking to buy five BMW X5s at full MSRP and all of them black – the most popular color for exported vehicles – knows the cars are likely floaters but might do the deal anyway and pray the factory never finds out. The buyers then typically sell the units to their overseas connections for a percentage of the profits.

Los Angeles is a hotbed of export activity due to its proximity to ports and because sales tax is not collected upfront of leases in California, allowing those exporters who do not pay cash to shell out only for license and title fees. In some cases, they have no intention of ever making the payments, leaving dealer, bank and automaker all pointing fingers at each other as to who is to blame for the swimming Bimmers.

Identity Theft

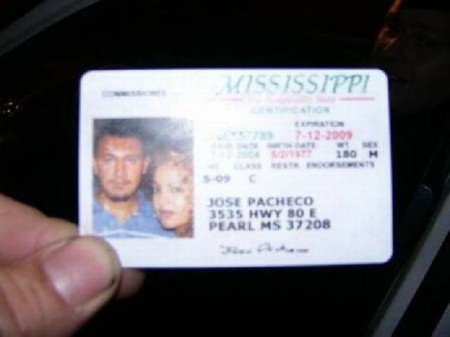

Though still the most common car acquisition scam, the number of cases of perps using identity theft to obtain a vehicle is on the decline thanks to the rise of companies like LifeLock that monitor credit bureau inquiries, and vigorous enforcement of the law. Driving around town in a stolen car nowadays also exposes you to the latest license-plate recognition technology used by law enforcement. Identity thieves nowadays are either amateurs who swipe relative’s documents and are usually quickly apprehended, or professionals who are looking to launch the vehicle on a slow float to China.

The pros are hard to catch by dealerships and banks, as they can create phony driver’s licenses in the victim’s name that are undetectable by stores’ fraud-fighting devices, have verifiable sham employers, and can throw down Academy Award-worthy acting performances.

The professional crooks are unfazed by the fact that most Los Angeles car dealers require a thumbprint from all buyers as part of their efforts to combat fraud. This process has led to a few instances of amateurs suddenly claiming they need to use the restroom and fleeing the dealership.

Sub-Leasing

This is the most complicated of car scams, and to banks the most frustrating. It begins with a confidence man finding clients with bad credit and promising them he will get them financed on a new vehicle – for a fee of course. He then recruits and pays a credit “mule,” a person with an excellent FICO score, to apply for a car loan or lease and actually take delivery of the vehicle with the agreement the con man will make the payments. He then hands the car off to the first customer and charges him several hundred dollars per month more than the negotiated payment. The crook makes one or two payments to the bank to throw them off the scent before he skips out. Meanwhile he keeps collecting the higher payments and the mule is getting collection calls from the bank.

Leave it to a group of criminals from the city of Glendale – LA’s fraud capital- to attempt the ultimate combo platter of automotive ploys. During a two-year period in the mid-2000s the gang stole over 200 vehicles by utilizing sub-leasing and ID theft. They subsequently reported the cars stolen, collected on the insurance proceeds, and donated the vehicles to their own fake charity which then shipped them to Russia. This overambitious bunch of bandits was eventually caught.

Falsifying Credit Applications

This scam is as old as the finance office – customers lying about their income, bank account balances or employment on a credit application in order to appear more credit-worthy to an automotive lender. Though traditionally done at the encouragement of dealership personnel (“Let’s just put down that you make $4,000 a month, OK?”), car buyers themselves are often guilty of fibbing. Both client and dealer may now access a number of websites that can produce fake account documents to fool a bank. Dealers caught in this act can face prison time plus lenders have long memories and a culpable dealership may have a hard time getting future loan applications approved.

Legend has it that one of the pioneers of producing bogus bank statements and W-2 forms to inflate a customer’s net worth and income was Houston’s Landmark Chevrolet (“Landshark Chevrolet” to the locals) during the 1980s, one of the chain of dealerships once owned by the notorious and now-bankrupt Bill Heard Enterprises.

(Houston is arguably the runner-up auto scam capital behind LA due in part to its dealerships’ history of hiring the type of shady, desperate employees that white collar fraudsters seek out. Consider the characters that have made the news in the past few weeks alone: a Houston Chevrolet dealership sales manager was shot and killed by a salesperson, the owner of another Chevy store was charged with the sexual assault of a 16 year-old girl, and a salesman was stabbed and shot on the lot of his Honda outlet. The city’s car scammers are also clueless: two men were recently arrested after renting an Altima from Hertz and then trying to sell it with a forged title claiming the car’s owner was named Marcus Hertz.)

Car Brokers

Compounding the fraud problems in Los Angeles is the fact that scammers will often hide behind car brokers. These operators, also known as “buyer’s agents,” charge dealers a fee of between $200 and $2,000 for the privilege of working with their clients. There are about 200 of these “bird dogs” in the LA area and they account for about 5% of luxury auto sales. Many brokers provide a valuable service to non-English speaking customers and to celebrities or shoppers who don’t want to endure the car buying process.

The problem lies in the fact that a few of the brokers are basically pond scum. Weak state licensing requirements means that literally anybody can become a car broker in California. Banks report that over 50% of the consumer fraud in Los Angeles can be traced to these companies. Working through a broker means the swindler never has to set foot in a dealership, and the broker is often their accomplice in an identity theft or falsified credit application scheme. One car broker was recently caught submitting the same fake bank statement on behalf of numerous clients.

Dealership managers grumble about brokers but know that if they do not work with them their neighboring dealer will. Sacramento lawmakers will likely never ban these parasites as they consider car dealers to be the root of all evil, so why pass any law that might help them? In addition, in 1965 the United States filed suit against General Motors and its Los Angeles Chevrolet dealers, accusing them of restraint of trade by conspiring to refuse to work with brokers and “discount houses,” and that suit still hangs over dealers’ and distributors’ heads like smog in the LA Basin.

Free Parts Cars For All

Finally, a LA dealership recently discovered that a returned loaner car had its engine replaced with one that had been thrashed. It turns out the con artist persuaded a buddy who owned the same brand of automobile to have it serviced at that dealer and obtain a loaner car of the same model as his with the bad engine. After swapping the motors and other parts, they returned the loaner.

The dim-witted delinquent who recently asked a dealer for a loaner with a specific VIN sequence, probably to insure the car had the correct engine, transmission or trim level needed for the replacement parts for his friend’s old vehicle, was thrown out on his ear.