Google's Trillion-Dollar Driverless Car - Part 3 (of 7): Sooner Than You Think

Such rapid progress offers great hope that the tremendous benefits in safety and savings I laid out in Part 1 of this series are attainable. The pace of progress also means that the disruptive ripple effects discussed in Part 2 might soon have strategic relevance for companies participating in the multi-trillion-dollar part of the economy that relates to cars. But we’re left with two crucial questions: How soon could the driverless car become a reality? When should incumbents, venture capitals and entrepreneurs start paying serious attention?

The short answer to both questions is: sooner than most think. This article explains why.

When estimating technology adoption, it is wise to remember Paul Saffo’s admonition to “never mistake a clear view for a short distance.” No matter how powerful a technology is, there are numerous factors that stand between technical viability and widespread adoption—cost, usability, customer acceptance, business models, entrenched interests, regulations and so on.

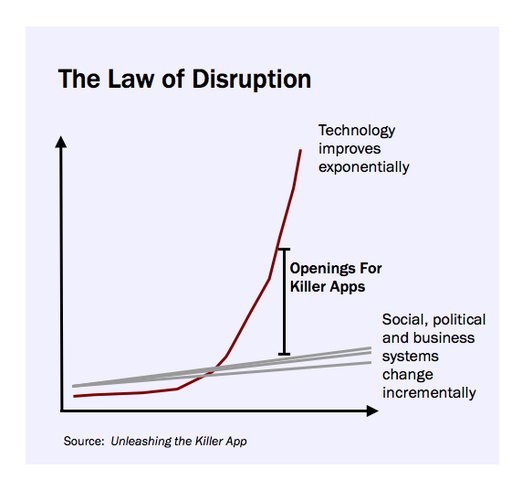

In “Unleashing the Killer App,” Larry Downes and I described the crucial dynamic as the Law of Disruption.

As illustrated in the figure, technology improves exponentially, but social, political and economic systems tend to change incrementally. Only when the differential between existing conditions and what is technically possible becomes large enough are human systems jolted into disruptive change. These jolts are the openings for “killer apps,” new goods or services that are so compelling that they catalyze a new generation of products. VisiCalc, the first spreadsheet, was the killer app for personal computers. Mosaic, the first browser, was the killer app for the World Wide Web. The iPad was the killer app for tablets.

Let’s look at the adoption of the driverless car through the lens of the Law of Disruption, to see both how advanced the technology is and what social, political and economic systems might delay the “killer app” jolt.

Technology is the easy part. There’s ample evidence that driverless technology from Google and others is already better than many drivers. In addition to the riveting video of a 95%-blind man “driving” a Google car that I showed in Part 1 of this series, here’s a montage of on-the-road clips narrated by Chris Urmson, who currently leads Google’s driverless program.

As you absorb Chris’ description, keep in mind that his examples are almost two years old. The car’s progress has continued at the exponential rate illustrated in Figure 1 and will even accelerate once significant numbers of cars reach the road. That’s because, while we humans learn almost entirely from our own experiences, every Google car can learn from the experiences of every other Google car.

Blanketing the roads with Google cars will also provide incredibly detailed, up-to-the second information to the “cloud” about road conditions, traffic and travel times. Each car will draw on that information and know to be extra careful at dangerous intersections or know, say, that black ice was felt at a certain spot 15 minutes earlier.

With progress so rapid, the technology in the Google car has miles and miles of open road in front of it. Even skeptics seem to believe that the question about the timing of the driverless car is less “if” than “when.”

But the social, political and economic systems that could act as a limiting function on “when” are significant. Consider some of the commonly voiced hurdles:

The car will cost too much. Estimates are that each Google research car costs more than $300,000. This means, as BusinessInsider noted, that it costs more than a Ferrari. Prices anywhere near these levels will keep the car out of reach for mass adoption.

Customers won’t buy it. There is a widespread sense that most customers would never give up their spot in the driver’s seat, or trust a driverless car.

There’s too much liability. In our litigious society, car makers would never offer products that took the human out of the loop and thus shifted the liability for accidents to themselves. Legal liability for car makers could be huge if a malfunctioning car injured or killed people.

The car violates current business models. As I laid out in Part 2, the driverless car has enormous ripple effects across a number of industries—some of which are quite dire. It could be in car makers’, car dealers’, insurers’, taxicab associations, etc., best interests to delay driverless technology as long as possible.

Also, in the short term, it might be more prudent for car makers to market driverless technology as expensive options to existing designs, rather than to take Google’s disruptive approach.

The transition would take decades. The fleet of cars on the road turns over roughly every 10 to 15 years, so even if driverless cars were in production today it would be many years before they dominated our highways and started delivering the promised benefits. If the driverless car takes that long to matter, it might never happen, or at least not happen in our lifetimes. After all, we’re still waiting for our Jetsons-like flying cars.

My sense is that even under incremental-change scenarios, some of these hurdles would dissolve rather quickly.

Cost is the easiest to address. The components on which the driverless car depends are improving at the speed of Moore’s Law. Following Moore’s Law, a gigabyte of memory cost $300,000 in 1981 but less than $10,000 a decade later, less than $10 a decade after that and less than 10 cents today. From $300,000 to a dime in three decades: That’s the trajectory that the electronics in the driverless car are on. Cost will also decrease as developers optimize their designs for production, as opposed to building prototypes.

Personal habits would surely slow adoption, but people could come to trust the cars as evidence of effectiveness piled up. New drivers, immersed in computing technology since birth, might be more trusting than older drivers. After all, lots of people used to be scared witless about flying, but that issue has largely faded. There’s already evidence that young people are much less interested in driving than those of us of a certain age were. It seems that being able to connect via Tumblr and Facebook reduces the need to actually drive somewhere and meet a friend face-to-face. And it might be that aging baby boomers, raised with a love of cars and independence but faced with diminishing driving abilities, would embrace driverless cars as the best of the options available to them.

The liability issue is trickier—computers are completely capable of flying planes, including takeoffs and landings, yet, for liability reasons, every commercial flight has two humans in pilot’s seats. A study by Rand Corp. concluded that existing liability case law “does not seem to present unusual liability concerns for owners or drivers of vehicles equipped with autonomous vehicle technologies.” Instead, the study predicted the decrease in the number of accidents and the associated lower insurance cost would encourage drivers and auto insurers to adopt the technology—unlike with airplanes, where deaths are rare, there are tens of thousands of preventable deaths in cars each year.

The same study did predict that manufacturers’ product liability would likely increase and that this might slow the introduction of the technology. The Rand study suggested, though, that government might intervene and mandate self-driving cars if they prove to be half as safe as Google claims. After all, almost 370,000 people died on American roads between 2001 and 2009 and millions more were injured.

I can think of three plausible scenarios that, based on the compelling societal benefits and business opportunities, might jumpstart adoption. (Please add your own in the comments section below.)

1. Google Fiber Redux. Google is the most likely player to put hundreds or thousands of driverless cars on the road to prove their effectiveness and clear away short-term hurdles. Google has a tradition of having its employees use its prototype technologies, a practice known as “eating your own dogfood.” Given recently passed legislation in California legalizing driverless cars (with backup drivers), Google might deploy hundreds of Google cars to chauffeur Googlers around the state. Google could quickly log millions of miles and accumulate mountains of evidence on the safety and benefits of the car. (According to various news reports, the Google car has thus far been hit twice by other drivers and once caused a minor accident—while under the control of a human driver.) Google could then move to pilot the technology at a larger scale, perhaps in Las Vegas, because Nevada has also approved the car. Google could use its deep pockets to invest in the necessary infrastructure, take the liabilities issues off the table (by essentially self-insuring) and make the cars available in Nevada at competitive prices. Such an effort would mirror the Google Fiber strategy in Kansas City to demonstrate the viability of high-speed fiber networks to the home.

2. The China Card. Although there are too many imponderables and cross-industry conflicts to imagine that the U.S. federal government would get involved any time soon, one can imagine scenarios where more interventionist governments, like China’s, might intervene. China has greater incentives to adopt driverless cars because its rates of accidents and fatalities per 100,000 vehicles is more than twice that of the U.S., and its vehicle counts and total fatalities are growing rapidly. In addition, the Chinese government could be motivated to accelerate the adoption of driverless cars because of the trillions of dollars that it would save by building fewer and narrower roads, by eliminating traffic lights and street lights and by reducing fuel consumption. And then there is the competitive dimension. A driverless car initiative would fit into several of the seven strategic industries that the government is supporting. Chinese researchers have already made significant progress in the arena. And, of course, if China perfects a driverless-car system, it could export that system to the rest of the world.

3. The Big Venture Play. In this scenario, a startup steps into the market to launch a large-scale, shared, driverless transportation system. While this might appear to be the most outlandish of the three scenarios, the outline of the a profitable business case has already been developed. The business plan was designed by an impressive team led by Lawrence Burns, the director of the Program on Sustainability at Columbia University’s Earth Institute and former head of R&D at General Motors. The plan is based on expert technical and financial analysis and offers three sustainable market-entry strategies. For example, the team did a detailed analysis of Ann Arbor, MI, and concluded that a shared-driverless system could be fielded that offered customers about 90% savings compared with the cost of personal car ownership—while delivering better user experiences. Analysis of suburban areas and high-density urban centers, with Manhattan as the case study, also yielded significant savings potential and better service. Such dramatic results promise tremendous business opportunities for a “NewCo”:

This is an extraordinary opportunity to realize superior margins, especially for first movers. In cities like Ann Arbor, for example, NewCo could price its personal mobility service at $7 per day (providing customers with a service comparable to car ownership with better utilization of their time) and still earn $5 per day off each subscriber. In Ann Arbor alone, 100,000 residents (1/3 of Ann Arbor’s population) using the service could result in a profit of $500,000 a day. Today, 240 million Americans own a car as a means of realizing personal mobility benefits. If NewCo realizes just a 1 percent market share (2.4 million customers) in the United States alone, its annual profit could be on the order of $4 billion. NewCo’s Business Plan explains how this idea can be realized quickly, efficiently and with effective risk management.

There are of course many assumptions built into such plans, but my review leads me to believe that it is a robust platform for serious exploration of the Big Venture Play.

* * *

So, yes, it’s tempting to think of the driverless car as science fiction that, even if comes to pass, will happen in someone else’s future, not ours. But the driverless car is hurtling toward us—and could be dramatically accelerated if one or more of my three scenarios happen.

Most companies that are in the auto industry or that touch it in any way—fleet managers, auto insurers, etc.—should be testing the waters and preparing to act sooner rather than later. A car company wouldn’t want to stand on the sidelines while Google, a China-funded conglomerate or some Big New Venture locks up all the core intellectual property and gain first mover advantage. Look what happened to IBM when it ceded the personal computer operating system to Microsoft and the processors to Intel, or when Microsoft allowed Apple and Google to dominate the mobile operating platform.

It is even conceivable that some Big Auto company might step up to an initiative like Google Fiber Redux or the Big Venture Play. In fact, the Earth Institute business plan I described came out of an initiative funded in part by General Motors and Volvo.

In addition to laying claim to the technology, companies need to participate in the lobbying fights that will define the territory long before driverless cars dominate. Car companies already feel constrained by state laws that limit their control over dealerships; the car makers don’t want to lose the next round in that sort of tussle.

Besides, the stock market often looks deep into the future and dings you for problems long before they show up on your bottom line. You can be Earthlink and have a great business as an Internet service provider, but if the world is clearly moving away from your dial-up technology and on to broadband, you lose. You have to have at least a credible story about how you’ll prosper in a new era. You can’t have that if you aren’t at least in the game.

- Fasten Your Seatbelts: Google’s Driverless Car Is Worth Trillions

- The Ripple Effects—As Far As The Eye Can See

- Why Change Will Come Sooner Than You Think

- How Google Wins

- How Automakers Still Win

- Will Auto Insurers Survive Their Collision with Driverless Cars?

- Driverless Cars Are Just One of Many Looming Disruptions