Japan in October 2012: Kei Cars Cushion Blow

In September, sales on all automobiles in Japan were down 3.4 %. This month, they are down 5.7 %. The fall would have been harder, would it not have been cushioned by the resilience of a Japanese oddity, the Kei car.

Regular vehicle sales Japan October 2012

Manufacturer | Oct ’12 | Oct ’11 | YoY | YTD ’12 | YTD ’11 | YoY |

Daihatsu | 233 | 441 | -47.2% | 2,536 | 2,578 | -1.6% |

Hino | 2,876 | 2,794 | 2.9% | 34,917 | 27,724 | 25.9% |

Honda | 20,006 | 36,355 | -45.0% | 385,469 | 314,810 | 22.4% |

Isuzu | 3,621 | 2,937 | 23.3% | 49,844 | 33,617 | 48.3% |

Lexus | 3,128 | 4,308 | -27.4% | 37,528 | 36,328 | 3.3% |

Mazda | 9,154 | 11,457 | -20.1% | 145,832 | 124,357 | 17.3% |

Mitsubishi | 5,376 | 4,063 | 32.3% | 51,657 | 46,955 | 10.0% |

Mitsubishi Fuso | 2,555 | 2,931 | -12.8% | 29,124 | 21,289 | 36.8% |

Nissan | 34,753 | 33,631 | 3.3% | 440,766 | 372,341 | 18.4% |

Subaru | 8,170 | 5,785 | 41.2% | 84,891 | 62,118 | 36.7% |

Suzuki | 4,945 | 6,025 | -17.9% | 77,982 | 64,927 | 20.1% |

Toyota | 114,405 | 122,208 | -6.4% | 1,389,389 | 935,800 | 48.5% |

UD Trucks | 707 | 855 | -17.3% | 7,593 | 6,638 | 14.4% |

Other | 15,614 | 14,137 | 10.4% | 194,343 | 165,396 | 17.5% |

Total | 225,543 | 247,927 | -9.0% | 2,931,871 | 2,214,878 | 32.4% |

Data courtesy Japan Automobile Dealers Association

Sales of regular vehicles were down 9 % in Japan, with Honda taking the biggest hit of Japan’s big three. This according to the Japanese Automobile Dealer Organization JADA. You may read elsewhere that the Japanese car market is down by that number, but it is not. A full 37 % of Japanese auto sales do not show up in this statistic.

Mini vehicle sales Japan October 2012

Manufacturer | Oct ’12 | Oct ’11 | YoY | YTD ’12 | YTD ’11 | YoY |

Suzuki | 41,494 | 39,263 | 5.7% | 504,300 | 392,994 | 28.3% |

Daihatsu | 44,372 | 52,148 | -14.9% | 585,797 | 445,466 | 31.5% |

Mitsubishi | 4,744 | 6,074 | -21.9% | 69,913 | 79,039 | -11.5% |

Subaru | 2,610 | 6,493 | -59.8% | 63,535 | 66,967 | -5.1% |

Honda | 23,885 | 10,306 | 131.8% | 264,788 | 106,336 | 149.0% |

Mazda | 4,009 | 3,822 | 4.9% | 45,545 | 38,606 | 18.0% |

Nissan | 9,769 | 13,225 | -26.1% | 133,560 | 119,063 | 12.2% |

Toyota | 2,903 | 1,845 | 57.3% | 37,926 | 2,061 | 1740.2% |

Other | 4 | 8 | -50.0% | 41 | 37 | 10.8% |

Total | 133,790 | 133,184 | 0.5% | 1,705,405 | 1,250,569 | 36.4% |

Data courtesy Japan Automobile Dealers Association

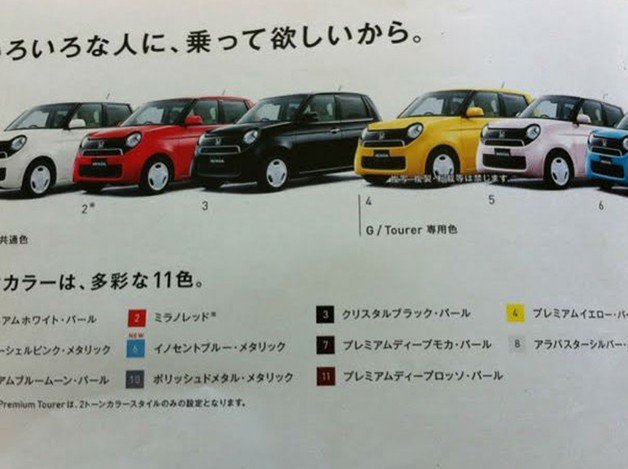

Sales of that Japanese foible, the mini vehicle, or Kei car, actually were up slightly, 0.5 % to 133,790 units, the Japan Mini Vehicles Association says. The 0.6 liter midget mobiles have seen an amazing resurgence recently. 1.7 million Keis were sold in Japan through October. Sales in the segment were driven by Honda’s N-Box. In September, nearly 20,000 units changed hands. The car received support from the N-Box +, and today from the N-one, a retro-styled Kei that took its cute cues from the N360, the first mass-produced Honda Kei, which was introduced in 1967.

Total vehicle sales Japan October 2012

Manufacturer | Oct ’12 | Oct ’11 | YoY | YTD ’12 | YTD ’11 | YoY |

Daihatsu | 44,605 | 52,589 | -15.2% | 588,333 | 448,044 | 31.3% |

Hino | 2,876 | 2,794 | 2.9% | 34,917 | 27,724 | 25.9% |

Honda | 43,891 | 46,661 | -5.9% | 650,257 | 421,146 | 54.4% |

Isuzu | 3,621 | 2,937 | 23.3% | 49,844 | 33,617 | 48.3% |

Lexus | 3,128 | 4,308 | -27.4% | 37,528 | 36,328 | 3.3% |

Mazda | 13,163 | 15,279 | -13.8% | 191,377 | 162,963 | 17.4% |

Mitsubishi | 10,120 | 10,137 | -0.2% | 121,570 | 125,994 | -3.5% |

Mitsubishi Fuso | 2,555 | 2,931 | -12.8% | 29,124 | 21,289 | 36.8% |

Nissan | 44,522 | 46,856 | -5.0% | 574,326 | 491,404 | 16.9% |

Subaru | 10,780 | 12,278 | -12.2% | 148,426 | 129,085 | 15.0% |

Suzuki | 46,439 | 45,288 | 2.5% | 582,282 | 457,921 | 27.2% |

Toyota | 117,308 | 124,053 | -5.4% | 1,427,315 | 937,861 | 52.2% |

UD Trucks | 707 | 855 | -17.3% | 7,593 | 6,638 | 14.4% |

Other | 15,618 | 14,145 | 10.4% | 194,384 | 165,433 | 17.5% |

Total | 359,333 | 381,111 | -5.7% | 4,637,276 | 3,465,447 | 33.8% |

Consolidating regular cars with Keis, the big picture looks like this. The market is 5.9 % lower than in October 2011. Despite a little, and less than expected weakness in September and October, both Honda and Toyota have grown their sales by more than 40 % through October. Toyota’s group sales including Daihatsu and Hino are up 45.1 %.

Related News