Suppliers Team Up to Provide Starter Kit for Self-Driving Cars

Now, two big Tier 1 suppliers think they have a solution for that problem.

Nvidia Corp., the Silicon Valley chipmaker with automotive clients such as Audi and Tesla, and Elektrobit, the Finnish software specialist bought this year by Germany's Continental AG, will join forces to sell an off-the-shelf supercomputer for autonomous driving, the companies announced last week.

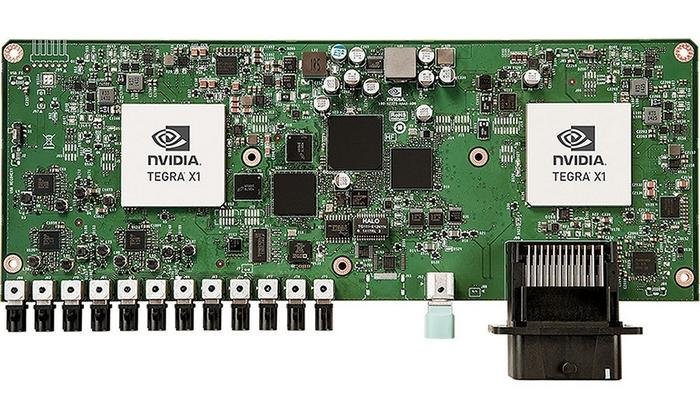

Nvidia will supply its Drive PX computer and "deep learning" software, while Elektrobit will supply a software kit that meshes Nvidia's computing power with the auto industry's standardized electronic architecture, known as AUTOSAR.

Using that combination, developers of self-driving cars would be able to focus on writing the specialized algorithms that guide a car through the world, without having to develop code just to communicate with the car.

"That is really complicated stuff, and some of it has never been done before," Danny Shapiro, senior director of automotive at Nvidia, said in an interview at the company's headquarters here. "What we're trying to do is build a more complete solution for customers, to make it more of a turnkey system."

Right now, car companies are competing to write the best algorithms so they can sell automated-driving features to customers. BMW and Mercedes-Benz already sell cars with "traffic-jam assist" features that take over the wheel and the pedals for brief periods at low speeds. Within the next few years, several car companies are expected to offer highway autopilot systems.

In the long run, however, these simpler applications may become less of a differentiator among automakers, argues Manuela Papadopol, global marketing director at Elektrobit. As technology matures, the auto industry may settle on a standard bundle of software so that all cars will react predictably to occupants, pedestrians and surrounding cars.

Elektrobit, which already works with Mercedes-Benz on software for driver-assist systems, hopes to be a key player in maintaining the software that's "under the hood."

"As the industry moves toward autonomous driving, car companies will be able to differentiate themselves by providing a user experience that makes their brand shine," Papadopol said. "It'll be like providing a business-class experience rather than a coach experience. What's happening under the hood shouldn't matter. It should just work."

Despite the alliance between Nvidia and Elektrobit, car companies still will have to work with two suppliers. Nvidia will sell its hardware with microcontrollers from Infineon, a third partner, already integrated. Elektrobit will sell its software under a separate contract.

Nvidia started shipping its development kit in May and has more than 50 customers to date, including automakers, traditional Tier 1 suppliers, technology companies and universities.

Related News