The average car can contribute up to ten times its original purchase price to government coffers during its lifetime. When the car is imported, customs and excise duties are levied. Each time vehicle ownership is transferred, a new registration fee is paid. Annual road tax is another major contributor. The National Transport Authority raises about Rs 1 billion annually from road tax payments. Now if we calculate the amount of VAT charged on vehicle acquisition, purchase of spare parts, including consumables like tyres, lubricating oil and fuel, we have an idea of the vast amount of revenues generated. The fuel item alone currently comprises a contribution of Rs 16 per litre of mogas and Rs 8 per litre of diesel, for various levies, plus VAT thereof.

Vehicles are subject to fines in case of road traffic offences. In 2009, there were 142,535 contraventions issued for traffic offences, including 40,000 for exceeding the speed limit. The figure is expected to be higher for 2010 and 2011. Vehicles also pay parking fees to the government. Compulsory vehicle insurance supports a large chunk of the insurance market. Lately, there has been a proposal to introduce a carbon tax on polluting vehicles. The Excise Act has been amended to provide, in addition to the excise duty chargeable on vehicles, for a carbon dioxide levy on polluting cars and for the granting of a carbon rebate on non polluting cars. The rate will be based on the carbon gram emission per kilometre. The motor-car is indeed a real cash cow in modern economics.

Market imperfection

The road taxation system creates a lot of inequalities. Taxation is based on ownership rather than usage. Two persons owning the same type of vehicle, but one using it every day whilst the other only at weekends, will both pay the same rate of road tax. Similarly, road tax is based on engine capacity of the vehicle, rather than on the number of kilometres driven. Another disparity is the existence of concessionary rates for certain economic activities. This is discriminatory in the sense that all economic sectors should be considered on an equal footing. Entrepreneurs are entrepreneurs, whatever is the field of operation. It is indeed not the role of a transport authority to discriminate.

Paying of road tax is another nightmare, and is bureaucratic. There has, however, been improvement, with the NTA decentralising its cash offices, and also using the postal network, but this only shifts the long queues from the NTA to the post offices, already burdened with the payment of social allowances and utility bills. The ideal solution would be to abolish road tax altogether, and incorporate it in the price of fuel. The more you drive, the more you pay! This also eliminates all bureaucracy, reduces congestion (both traffic and people) at NTA offices and post offices, not to mention the current cost of collection.

Road safety

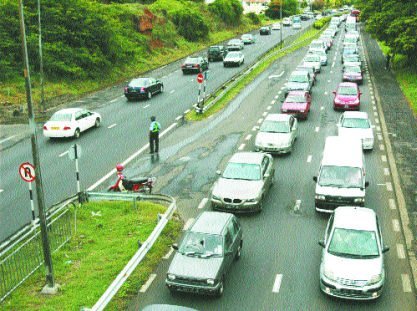

Road safety is an issue that fuels unending debates. Two wheelers account for over 40% of our vehicle population, but they are the most vulnerable users on our roads, as most road infrastructure projects fail to consider safety aspects for motorcyclists. The number of two wheelers will continue to grow, with more dealers, more imports and new brands and models being introduced on the market. It is urgent that we come up with a two-wheeler management scheme. Similarly, for pedestrians, absence of proper pavements in most areas increases accident risks. Whilst it is almost impossible to widen roads or construct new pavements in built up areas, planning guidelines should force new developments to reserve sufficient space for future construction of pedestrian walkways.

Each time there is a road mishap, a lot of lessons are learnt, but few corrective actions follow. Despite the authorities’ firm determination to curb accidents, and the massive investment in improving road infrastructure, fatalities continue to occur, sometimes where we least expect it. Our policies might be right, but our mode of operation wrong. Otherwise how can we explain steady recurrences as revealed by statistics? What is probably lacking is a general risk assessment. On the other hand, we might well have the best of policies and the strictest of rules, but if road users themselves fail to adopt a positive attitude and be more alert, responsive and responsible, then we are back to square one. Gambling is indeed legal in this country but to think that most people will go the extent of gambling with their own lives on our roads is simply beyond understanding. It is a fact that many drivers just take a chance, be it when overtaking or leaving a junction. Hazard perception is totally non-existent. Driving is not just physical manipulation of the steering wheel and the foot pedals, but requires a coordination of hands and brain. A good driver must be able to anticipate what lies ahead for at least 500 metres! The downside is that you might be the best of drivers, taking all necessary precautions but still end up being a victim because someone else is not like you. Unfortunately, the root cause is education, or rather the lack of it.

(Note: this paper was written before the Mt Ory mishap and does not bear any allusion to it)