Alternative Portfolios: Balancing Stocks, Bonds and Old Cars?

A few firms are even putting together private funds that let investors pool their money to buy portfolios of these assets, often charging hedge-fund-like fees of 2% of assets and 20% of gains.

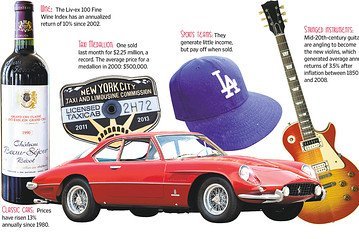

Skepticism is essential, but some of the sales pitches are compelling. Since 1980, for example, classic cars have appreciated by 13% per year, according to the Historic Automobile Group International, an investment-research firm in London—while large-company stocks have returned about 11% annually, including dividends, according to investment-research firm Morningstar.

Be warned: Many of the alternative investments, sometimes called “treasure assets,” are inherently speculative. For example, while collectors might think classic cars, such as the Mercedes-Benz SL300 Gullwing, are rolling works of art, they have no intrinsic value other than what the next buyer is willing to pay. The same goes for luxury asset classes like fine wine, stringed instruments and diamonds.

Many of the items are also relatively “illiquid,” or hard to sell quickly. Unloading, say, a vintage Gibson Les Paul electric guitar can take months, and commissions and fees will eat into your profit. Some of the new private investment funds lock up investors’ money for at least five years before letting them cash out. That makes these assets poor choices for short-term investors.

Nouvelles connexes