Electric Car: Reduction of Tax Applied

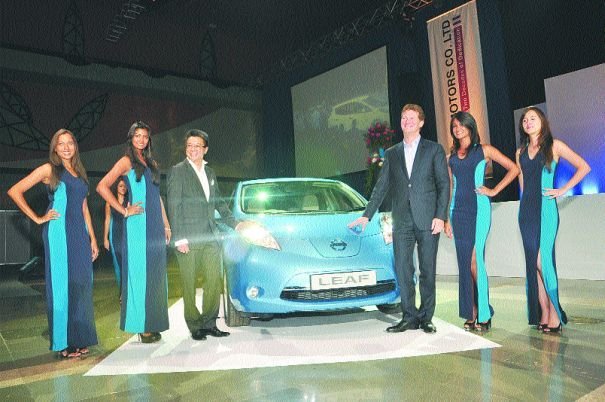

A few days before the presentation of the national budget in 2013, eight months after the official launch of the Nissan Leaf , the question comes up to perhaps give hope to advocates of sustainable development.

ABC Motors, the dealer who was able to convince the Japanese to include Maurice top seven countries selected for the global launch of the 100% electric car, salvation would come from the tax incentive to import. Singapore, this direction has already shown the way.

In a letter to Finance Minister Xavier-Luc Duval, ABC Motors calls for a reduction in excise duty of 27.5% for all electric vehicle. The dealer offers in the same breath, a broadening of the base bonus on the carbon tax to include this category of vehicle, including a major attraction remains its zero emission.

"It is the duty of the state around the world to fight against CO2 emissions and reduce dependence on fossil fuels and petroleum-based fuels, "say the leaders of ABC Motors, specifying a means of to achieve this is to encourage the use of electric vehicles. Dealer of Nissan Leaf suggests that independent power producers who supply the national grid have tax incentives for the purchase of an electric vehicle.

Electric vehicle is a savings of 75 to 80% of costs use and maintenance. The purchase price is amortized over time. In addition, Mauritius, we do not travel long distances from one point to another: a full battery charge can travel up to 160 km.