Japanese Car Makers Lose Their Midsize Edge

But when looking for a new vehicle a few months ago, the 63-year-old Templeton, Calif., sales manager broadened his search, checking out models from Volkswagen AG, Hyundai Motor Co. and the Detroit auto makers. He wound up buying a Fusion Hybrid, from Ford Motor Co., his first domestic-brand car in years.

Mr. Smith said he felt “an emotional connection” to the $27,200 Fusion’s curvaceous creases and edgy design. Ford’s gains in reliability and fuel economy were a selling point, too. “The Fusion just won in every category,” he said.

His purchase reflects a fundamental shift in the large and influential midsize sedan market. Competition is greater and consumer deals are rising. Nissan last week cut the list price of its redesigned Altima by 2.7%, or $580, and General Motors Co. in February dropped its Malibu sticker by up to $770 and is offering rebates.

A weaker yen may give other Japanese makers room to lower prices as well.

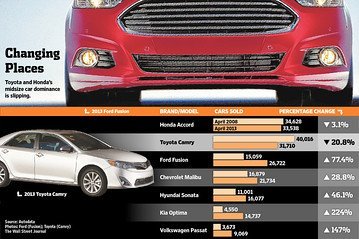

A few years ago, Toyota Motor Corp.’s Camry and Honda Motor Co.’s Accord were top sellers by a wide margin. Their share fell to 28% in the first quarter, from 37% of the U.S. midsize sedan market in 2008, according to Edmunds.

Now, it is a wide-open market. Ford and GM have turned their midsize sedans into real challengers and closed the quality gap with Japan; meanwhile, the Japanese were knocked off stride by recall troubles that hurt Toyota in 2010 and production disruptions in Japan that resulted from the 2011 earthquake and tsunami.

The rising challengers include Ford’s Fusion, with a 11.9% share of U.S. sales through April, up from 6.8% for all of 2008, Kia Motors Corp.’s Optima at 6%, up 3.9 percentage points, and Volkswagen AG’s Passat at 3.9%, up 2.5 percentage points, according to auto website Edmunds.com.

“We’ve never had anything like this,” said Michael J. Jackson, chief executive of AutoNation Inc., a large chain of new-car dealerships. “If you look at the quality, innovation and distinctive design of these midsize vehicles, this is what luxury cars used to be 10, 15 years ago.”

Related News